After an already very successful year in 2021, and in a fluctuating economic environment, MBA Capital managed to exceed 40 supported transactions in 2022, including several with clients generating over €50 million in revenue.

At the beginning of 2022, the economic context for our clients was favorable, although there were still some bottlenecks on the side of supply chains, namely, semiconductor shortages persisted, and another wave of the pandemic emerged(5th) with the Omicron variant, despite which we envisioned continuing the momentum of 2021's growth (+6.8%). However, the Ukraine conflict, surging energy prices (particularly gas), accelerating inflation and interest rates, declining household purchasing power and consumption, workforce shortages across many sectors, a sluggish China due to its zero-COVID policy, and supply constraints unseen in decades, resulting in significant cost increases in the industry and construction sectors, all arrived. Nevertheless, INSEE notes a business climate marked by 'hesitation and resilience'.

What we observe on our side: we have not noticed any slowdown in the pace or number of our operations.

Across all 10 of our offices in France, we have thus supported and advised on 24 transmissions (accounting for 59% of our operations), 15 acquisitions, one merger, and a capital-transmission fundraising.

In terms of sectors of activity, we have been involved in diverse industries, with a predominant focus on service-related activities in the broadest sense.

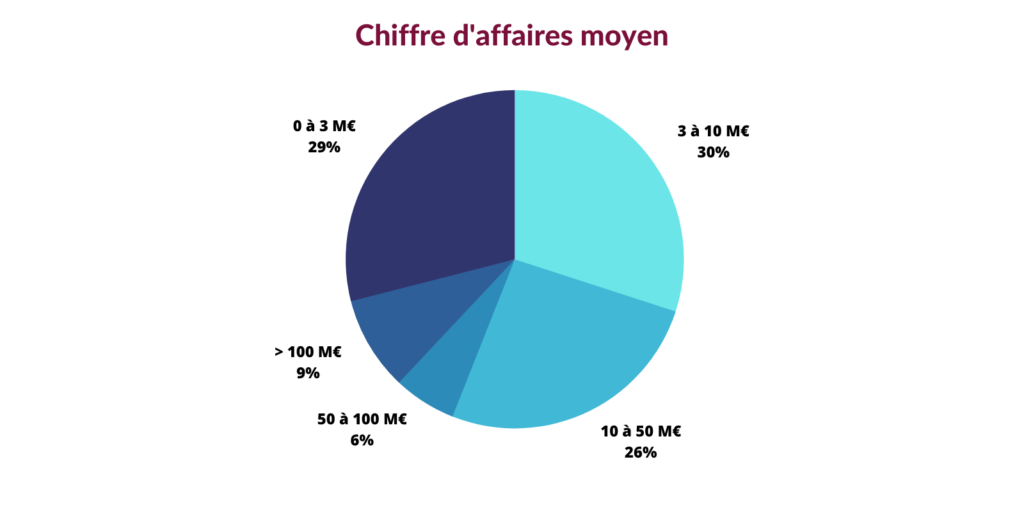

Our clients are primarily family-owned SMEs, with revenues ranging from 2 to 200 million euros.

Updated on March 22, 2023

To receive the latest information from MBA Capital, subscribe to the newsletter!