Bordeaux | Caen | Lille | Lyon | Marseille | Mulhouse | Nantes | Paris | Rennes | Strasbourg |

MBA Capital advises shareholders and managers of companies, SMEs and ETIs, from the definition to the realization of their growth, financial engineering and international development projects.

Years of experience.

Transactions of high

balance sheet realized.

MBA Capital, a team of experts who accompany companies and provide strategic financial advice.

MBA Capital is a leading player in transactions on behalf of SMEs, ETIs or large groups in all sectors of activity.

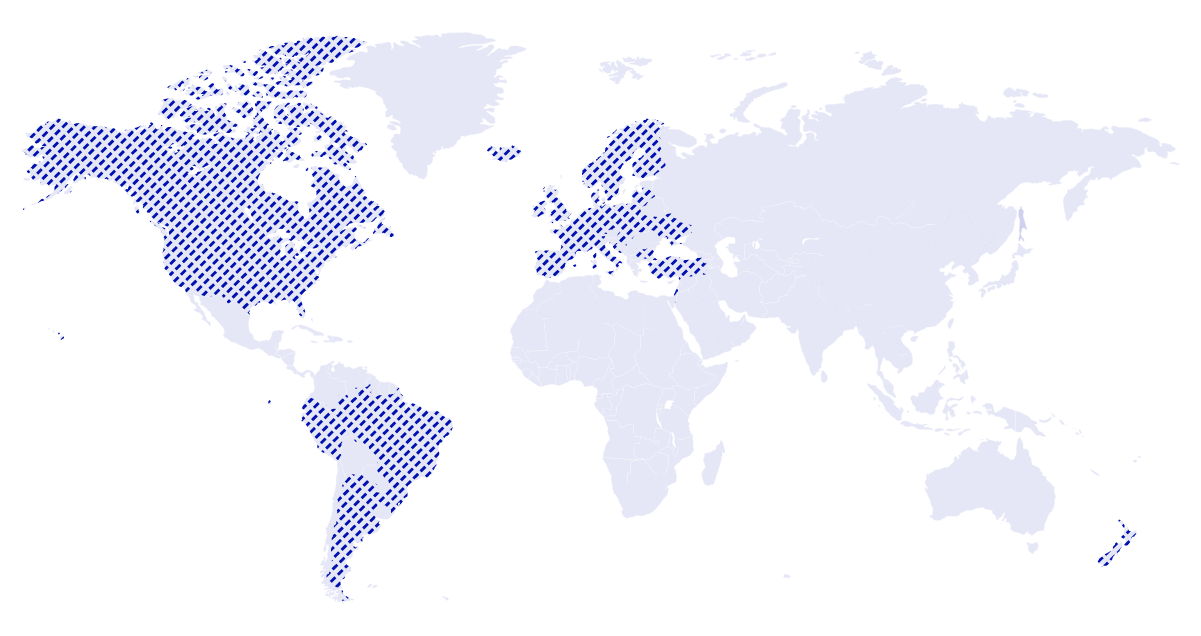

M&A Worldwide has 43 member firms in 45 countries with more than 1,000 equity transactions completed.

Privileged interlocutor for sellers, buyers, investors, lenders and advisory services.

Advising shareholders and managers whose interests are defended in all loyalty.

« We are always looking for external growth opportunities, in partnership with MBA Capital of course! »

« It's always reassuring to rely on recommendations from people you work with in confidence. »

« The relationship was so constructive that I didn't even feel like I was dealing with service providers! They were people who accompanied me with a strong social dimension and in whom I had complete confidence. »

MBA Capital consists of 10 M&A firms at the heart of the economic fabric of each region. Being close to its clients, both geographically and humanly, allows MBA Capital to be regularly ranked among the top players in France dedicated to Small and Mid-caps.

Offices.

Banquiers d'affaires.

Réunissant 44 cabinets de 33 pays, pour accompagner vos projets à l’international

Professionnels.

Millards d'euros. Valeur des transactions au cours des 5 dernières années.

Groupes sectoriels.

To receive the latest information from MBA Capital, subscribe to the newsletter!